Budgeting

A budget is an itemized summary of your income and expenses for a given period. It helps you determine whether you can grab that bite to eat or head home for a plate of leftovers.

Planning and monitoring your budget will help you identify wasteful expenditures, adapt quickly as your financial situation changes, and achieve your financial goals.

Video link: https://www.youtube.com/watch?v=QJVpqE7Sl2w&t=4s

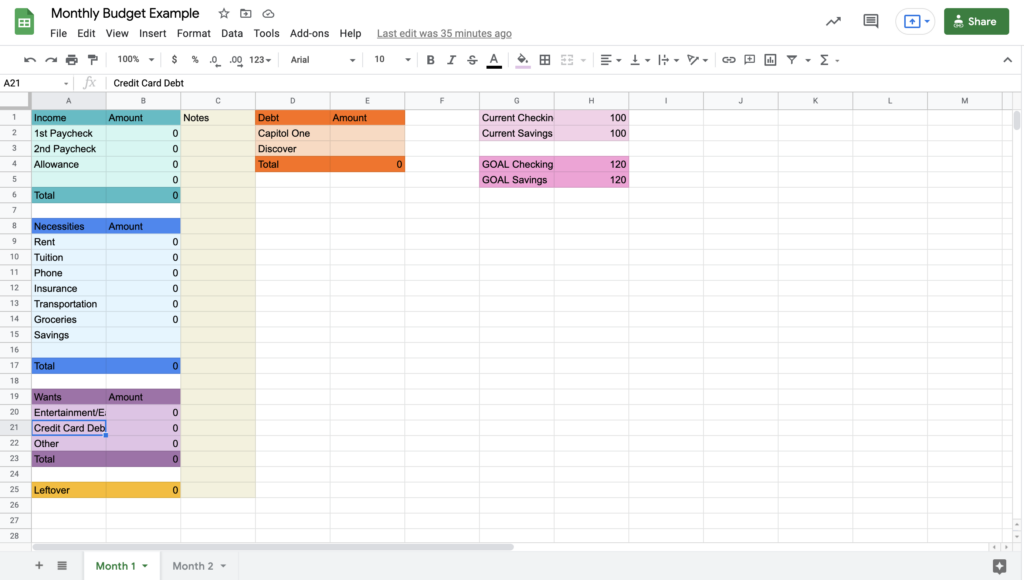

How to Start a Budget on Google Sheets

- Determine whether you want your budget to be monthly, biweekly, or semesterly

Most people average their monthly income with monthly costs but you can also try biweekly since that’s how GU pays students or anything that works with your income/spending habits.

- Gather your income total

Calculate your paystubs and other forms of income (paycheck, allowance, side hustle, etc). Once you add them up that is your total income.

- Gather your fixed expenses total

Fixed income includes things you need to live: Rent, tuition, groceries, utilities, tuition, insurance, savings etc. These are typically non-negotiable.

- Gather your flexible expenses total

Flexible expenses include things you don’t always need or amount can change: Clothes, entertainment, eating out, etc. (it’s okay to guesstimate

- Subtract fixed expenses and flexible expenses

Underbudget? Adjust your flexible spending so you eat home more, share your entertainment cost, or maybe thrift your clothes!

Have leftover money? Save it or allot it to your flexible expenses to treat yourself! - Lastly, log in your actual expenses at the end of your budget cycle and readjust as needed

- Extra tip: keep track of total money in your accounts, credit card debt, note extra costs that month, future goals on there (like do you want to open a Roth IRA)

Other Budgeting Options

Mint is a great option for beginners, especially if you use Turbo Tax because they are both used by Intuit.

PocketGuard is also a great option for beginners! It presents a simpler interface that some may prefer over Mint.

Your banking app lacking categorizes your spending, so if you want to stay in-app and only have one bank then this is also a great stress-free option!