Credit & Loans

What is Debt?

Debt is an amount due or owed to a person or entity. Most students have debt in the form of credit card payments and student loans. Although you may understandably get into debt in order to pay for your education, debt can pile up and become a big burden. We want you to stay well informed on student debt; this includes the different types that exist, how the interest on loans work, and how to avoid debt altogether. Debt isn’t something we want to have on our minds, but it is important to at least know some basic facts about it.

What costs are associated with Debt?

When you borrow money (such as through student loans or credit cards), you have to cover the principal and interest. A principal is an amount you initially borrowed. For example, if you spend $1,000 on your credit cards, then that $1,000 is your principal amount. However, when you receive your statement, you will notice that interest is assessed. If the interest you have is ‘simple’ interest, interest is calculated off the principal. So, take those same $1,000 dollars and add on the interest rate, say 20%: (20%)($1,000) for every year of repayment. Alternatively, compounding interest is calculated on the principal amount and also on the accumulated interest of previous periods, essentially “interest on interest.” For example, taking that same $1,000, the first year of interest would be (.20)($1,000), and the second year would be (.20)($1,200), because we take year 1’s interest into consideration. Make sure to carefully review the terms of your loan to see what kind of interest you are incurring.

Taking the example from the above text, a credit card charge of $1,000 would incur $612 in interest costs if you wanted to pay it off in 5 years. This means that you would be paying 20% interest with an expected payment of $26 a month. It also assumes that you don’t make any additional charges to the card. This accumulated interest is 60% of your original loan. Don’t forget to consider the interest costs and the time frame in which you want to pay back your debt when charging a card or taking out a loan.

How to avoid Debt

- Credit cards should only be used if you can pay off the balance immediately. Remember that there is a period of disconnect between swiping your card and the money leaving your account. Control borrowing by getting yourself on a budget, and use any leftover income to pay down debt beyond your minimum payment (what the credit company or student loan provider requires you to pay). It is important to pay more than the minimum payment to avoid incurring interest; the more you pay now, the less you pay overall.

- When deciding whether to take out a loan make sure you plan out your repayment strategy. Consider interest you will accrue, your income flow, and future costs.

What is credit and how do you build it?

Credit is the ability to borrow money or access goods or services with the understanding that you’ll pay later (Experian ). People that have a social security number and/or a Tax ID number qualify for taking out loans/credit cards, therefore they are able to build a credit score. Credit scores are calculated based on payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%) (myFico). The easiest way to build your credit is through credit cards and another common way is through loans. The best way to ensure that you have a positive credit record is to always make payments in a timely manner, pay more than the minimum payment (all if possible), and only spend a portion (11%) of credit available to you. Keep in mind that your credit score determines your eligibility and rates for things such as private loans, mortgages, car payments, even some jobs. Therefore, it is always important to monitor your score shown below and maybe use a company such as Credit Karma to keep track of your estimated credit score.

Important Note: when a potential lender (i.e. bank) has to pull your credit report in order to see if you qualify for a credit card/loan it can temporarily decrease your score so beware of applying for too many loans at the same time!

How do credit cards work and should you get one?

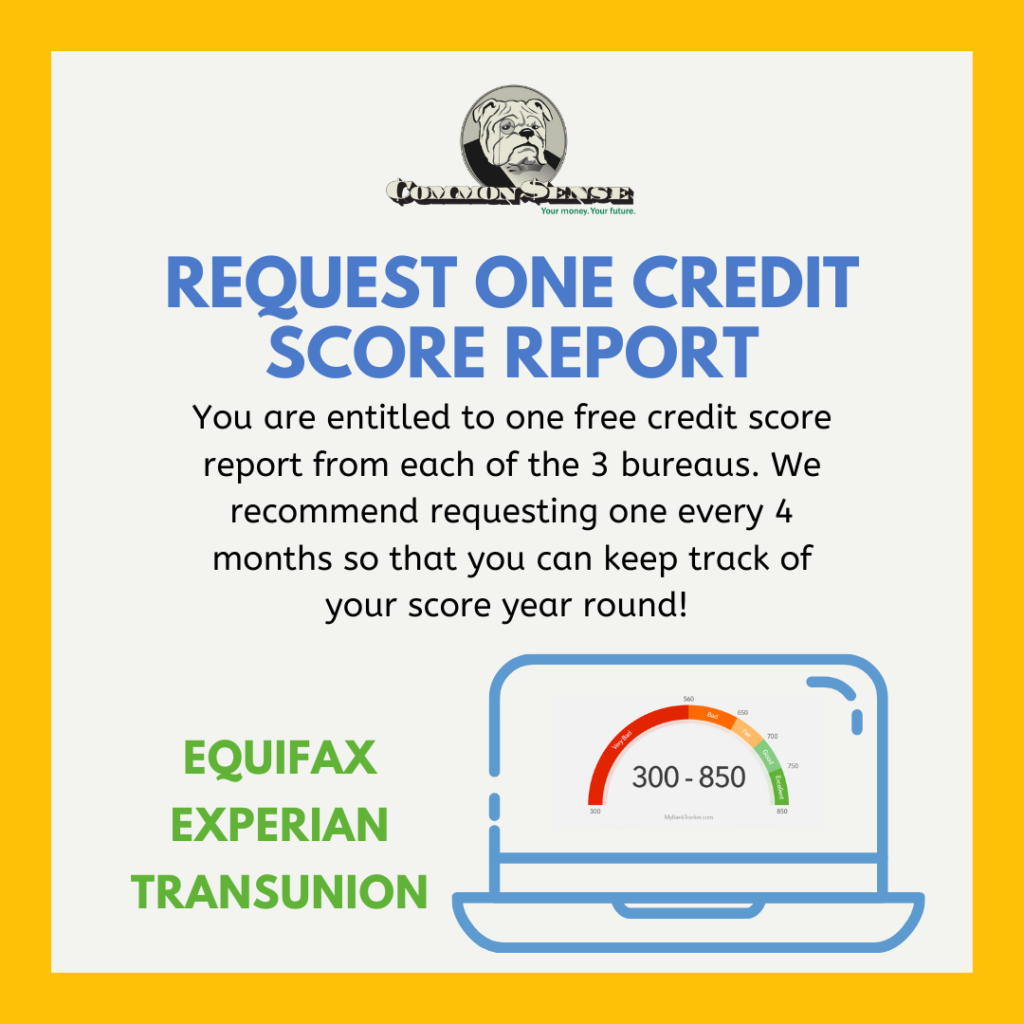

Credit cards aren’t for everyone. However, they can be a powerful tool for building your credit. Below are some basics when examining different types of credit cards. Just make sure that if you do utilize one, do not spend beyond your means and always pay off the balance in full if possible!

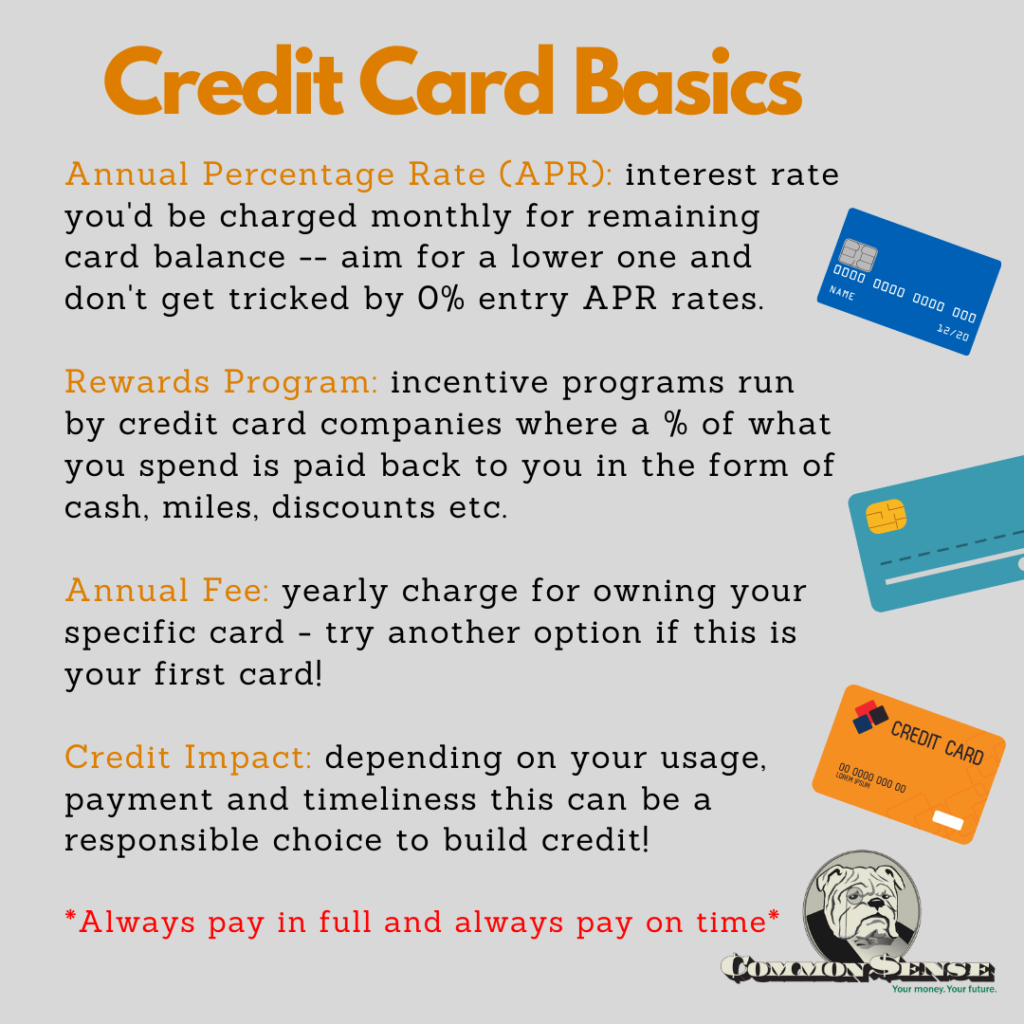

How do Federal Direct Student Loans work?

If you are eligible, you will be offered federal direct loans and the chart above can show you key differences between both loans. Regardless of the loan type, once you graduate, drop below half-time enrollment or leave, you will have a 6 month “grace period” (a time when you don’t have to start repaying). Once repayment begins it will be up to your lender to provide a schedule for your payments. Don’t fret to much if you go back to school or can’t meet your monthly payments, there are guidelines on studentaid.gov that will help you through the repayment process.