Taxes

Do you have to file taxes as a college student?

Check out this quiz to see

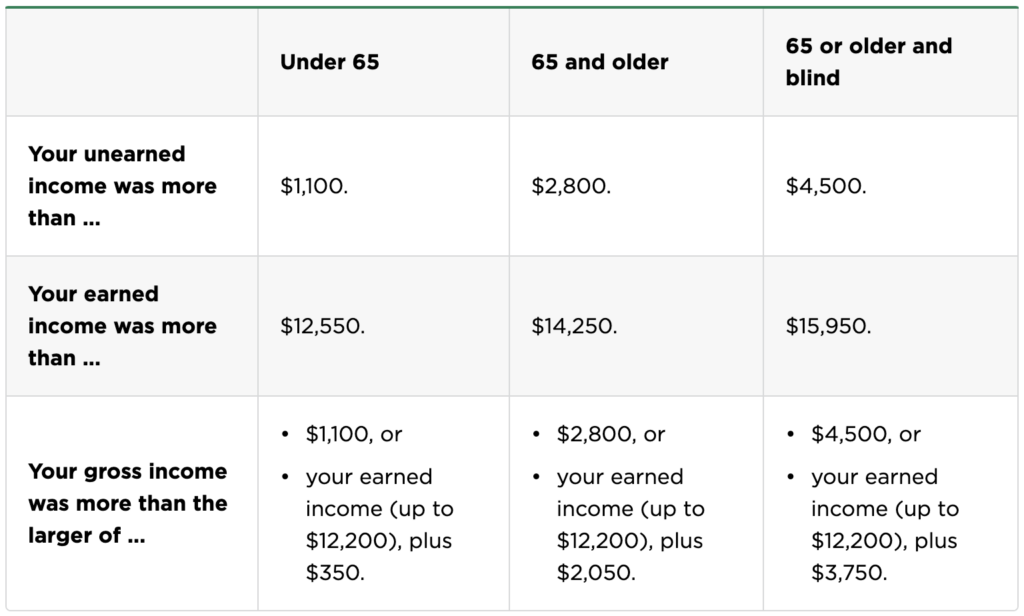

If you are a dependant you must make the following in gross income to have to file taxes

If your parents claim you as a dependant and you are single:

Did you work in a state that collects income tax?

You may need to file a state tax return in addition to filing federal taxes. If you moved for school and worked in two states, you may need to file two part-year returns. Your state tax website will be the best source of information on if you need to pay state taxes as a student. (DC has a “state” tax)

If you worked, did your employer withhold taxes from your paycheck?

If so, you could get some money back. So, even if you don’t have to file taxes as a student, you may want to. Additionally, full-time students might qualify for a returnable tax credit

Types of Forms

1040

This is the basic income-reporting form that nearly everyone uses. You might have to complete multiple add-ons called schedules. You should complete Schedule 1 if you made student loan payments. Complete Schedule 3 if you want to claim credits for education or child care expenses.

State tax return forms:

States have their own rules for who must pay state taxes. State tax websites typically provide forms for residents, nonresidents, and part-year residents.

1098-T

This form tells the IRS how much you paid in tuition and fees. Your school completes it and mails it to you or a parent. You need to include it when you file your taxes.

W-2

If you made $600 or more at work last year, your employer must provide you with a W-2. This form will show if you had any income tax withheld. Make sure you include it when you file your tax return.

W-7

DACA and undocumented students pay taxes with the same forms as students with citizenship. The only difference occurs when these students do not have a social security number (SSN) and if their individual taxpayer identification number (ITIN) is expired. A W7 should be completed to apply for or renew an ITIN. Submit it with the rest of your tax return. You do not need this form if you have an SSN or active ITIN.

1042-S

This form is like the 1040 for international students. Your employer will give you this form to report the income you earned. If your college awarded you certain stipends or travel grants, it would mail you this form.

Resources to File Your Taxes

IRS Free File: If your adjusted gross income is less than $73,000, you qualify for free guided tax preparation through an IRS partner site.

H&R Block: This service allows you to prepare your state and federal taxes for free. It includes forms that are helpful for student taxes, such as tuition deduction forms. You can also purchase time with a tax pro for extra help.

TurboTax – This service guides you through a user-friendly interface that asks you questions and accepts your forms, you should only need to use the FREE version!